6 Go to the ant, you sluggard! Consider her ways and be wise, 7 Which, having no captain, Overseer or ruler, 8 provides her supplies in the summer, and gathers her food in the harvest. 9 How long will you slumber, O sluggard? When will you rise from your sleep? 10 A little sleep, a little slumber, a little folding of the hands to sleep 11 So shall your poverty come on you like a prowler, and your need like an armed man.

Proverbs 6:6-11 [NKJV]

I took a little bit of personal time this morning to do the right thing (financially speaking), and it actually felt good. After spending so long with no financial stability, nor the means to actually meet some of my daily needs/commitments, it felt good knowing that I am finally able to fulfil those commitments again. While it is only fair and true to say that part of the reason why I am in my current situation today isn’t my fault, or due to a lack of effort or trying; it is also fair that I accept some of the responsibility because I know that if I have done a better job of preparing myself during the better/good times in my life previously, things probably wouldn’t have become as dire as they are today. So yes, part of the reason I am where I am today is because I failed to prepare myself early (or when I can). I procrastinated thinking to myself that I can always start doing something tomorrow, or next week, or next month. But I always ended up putting things off until the very last minute (or when I’ve ran out of time).

So today’s daily bread will speak to two things in my life, and I am hoping that it might also speak to some of you as well (if this is the message that you need for today):

- Better Financial Planning & Acting on it

- Stop Procrastinating (Seizing the Moment)

Better Financial Planning & Acting on It

So let’s begin with the most important part of today’s reflection/discussion – financial planning. One of my greatest failures in my life is that I am not always consistently successful or self-disciplined with my own financial plans and acting upon them. There are certain periods of my life where I think I was able to do a pretty good job of it. But it is also very clear to me that there were periods where I really fumbled the ball and made a mess of it. So, in hindsight, I would say that I’ve developed a very good understanding of what it is like when I do well in my financial planning, and what the consequences will be like when I lack the self-discipline to stick to my financial plans/goals. Let’s just say that the consequences are not worth it.

Taken a lot of Risks

To be absolutely honest and transparent, during the first part of my journey for the past almost 20 years, I have taken a lot of personal risks in an effort to follow my passions and to pursue it. And I did all of it without any support from my own family/parents. This was a decision that never stood well with them, and so in their eyes, I was on my own. I had to go figure it out. And if something goes wrong, then yes, I would have to face/bear the consequences myself. So yes, when you consider that context of how my journey has been for the past 19 odd years, I did have to take that occasional risk from time to time. There are times when my risks paid off, and it would be really rewarding. But there were also times when my risks would result in disaster and I would also have to face that on my own. That is how it has been for me for the past nearly 20 years.

I can Start Taking Less Risks

With my most recent career breakthrough, it also means one positive news for me – I can finally start to take less risk in my life. Less risky choices that could potentially have less riskier consequences for me. This also means that when things are less uncertain, I will finally be able to plan better and also stick to my goals/plans. One thing that for sure kept me from acting upon my a lot of my financial goals/plans is because of the uncertainty that came with taking all those risks in the past. I wasn’t always very sure if my plans would last more than 3 months, or 6 months. At my worst, I wasn’t even sure my plan could last the week. I had to spend a lot of time living day-by-day.

Being Realistic with Myself and Others

The other part of making a successful financial plan/goal (something I’ve done before) is by being realistic and practical with myself. While I might have failed in order areas like self-discipline and procrastination, the one area I am always very good at is how I plan and how I look at my finances. I’ve always been very practical and realistic about my spending habits (especially more so in recent years). I know how to be real with myself about what I can afford and how much I should be spending on food, or transport, and so on. I will never allow myself to spend more than I need to.

Looking ahead at where my life is now and where I want to be ultimately, I know that this realistic, down-to-earth part of me will be very beneficial to my whole plan. Also, because of how others have been helping me in recent weeks/days, I will eventually have to pay them back too. And I want to. I’m glad to. But I am also going to be very realistic and honest with them about what I can manage and how much I can repay them every month. That, in the short to mid-term will also help to build trust because they will know that I am dependable. That when I set a goal, or say that I will do something that I will be able to stick to those commitments.

Stop Procrastinating (Seizing the Moment)

The other really painful lesson that I have learned in recent years, is that the best time for us to prepare ourselves and be ready for the rainy days/storms in life, is actually when life is good. The mistake that I made in the past is that I thought I should allow myself to enjoy my life when times are good. YOLO you know. But turns out, it is super un-wise and not how we really should be living in real life. We can’t always “YOLO”. It is the quickest way to financial disaster, that I can testify.

So, I am making a 180 degree change. Instead of trying to enjoy my life like I used to before, I’m going to focus 90% of my effort on saving up and setting money aside for the rainy days. Just because things are finally turning around for me now, it doesn’t mean that things will forever remain that way. Life is always unpredictable. So it is our responsibility to prepare when the time is right. Like the ant during summer. They don’t wait until winter is near to start stockpiling food. The colony will starve during winter if they did that. No, instead, they would spend the whole summer time gather and stockpiling because they know that life is unpredictable. Who knows whether the summer would be shorter, and the winter might be longer than the year before, right?

Enjoying Life, Just a Little, and with Moderation

This is where I want to be very clear about my standing and beliefs today. I do believe that when it comes to living our lives, that it is okay for us to enjoy life a little. There is nothing wrong with wanting to occasionally pamper ourselves, or treat ourselves to a nice meal, or to celebrate a breakthrough, or a special moment. There is nothing wrong with that. Life shouldn’t just be all about seriousness, otherwise, what is the point of living right?

But here is where I would also draw my own line. I will prioritize saving up and spending less every month moving forward. If there is something I desire, or if I really hope to treat myself to something nice, I will only do it once in a while. What is more important to me now is knowing that my bank account/savings is always flushed/loaded. That is what I am aiming for in the very near future.

Saving Up While Paying Off My Debts

This is also something that I want to be very clear. I want to prioritize saving up above everything else. That includes paying off my debts. I’ve learned an incredibly painful lesson that whatever plan we create, whatever plan I am acting on, it has to be practical and realistic. It has to be done in moderation (with prudence). You can’t just commit to something and be 100% all in on it. I mean, within the context of being financially wise, it’s important to make sure that there is enough to go around.

Speaking to a friend on Friday night, I told him the very same thing. I hope that even after I begin working for this new company, I want to continue engaging in part-time and freelance-related work opportunities on the side. I want to do that because I know that I need that extra income. That extra income will help to serve two purposes:

- To give me more money to pay off my debts in a shorter amount of time.

- To put some of it into my savings even as I continue to clear my debts.

To me, these two priorities aren’t mutually exclusive. Both having savings and clearing my debts are important and urgent. So I want to make sure that I do it right this time.

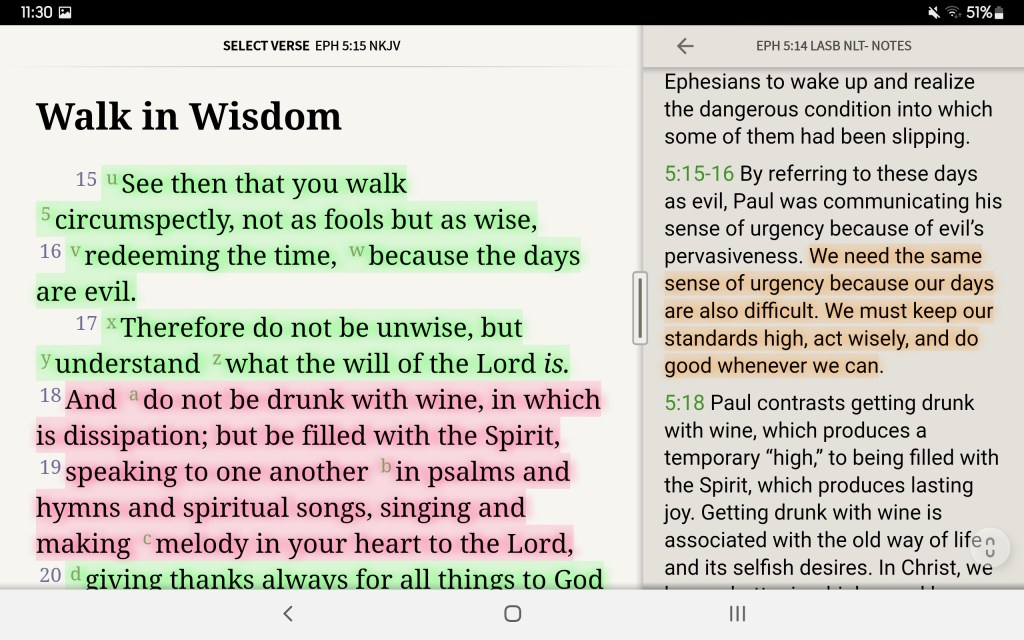

The above passage from Ephesians 5 is a reminder for me that we (I) need to learn to seize the moment in our days. Every single moment of every day. This time that we have to do something in our lives, once it is passed, we will never be able to get them back. Ever. So yes, it is down to us (me) to always be redeeming the time that I have now. Doing all that I can to make the best/most of it. That is the only way that I know when I look back to this moment some day in the future, I won’t have to live with anymore regrets.

Personal Prayers for Today

Dear Father in Heaven,

Thank You for speaking to me today about this lessons that I have learned in recent years. It certainly feels a lot like a re-cap and also a reminder of what I need to remember as I continue to move forward towards a better time in my life. A reminder that I must never be complacent, and I must stop procrastinating with my financial plans/goals.

Today, You have also reminded me that it is possible to succeed when it comes to having a financial plan and sticking to it. And I also remembered how rewarding it felt during those periods of my life when I was able to stick to my plans. And that is the kind of feeling that I am working towards today.

Thank You for also reminding me to continue to be wise and prudent when it comes to how I manage my finances and debt-repayment moving forward. It is without a doubt better to be wise and think long-term, rather than to enjoy only in the short-term.

Thank You for this lesson and wisdom. I know that as long as I keep apply these lessons in my life in the months and years to come, I will be in a much better place in the future. And I will never have to go through what I have been through for the past two years plus. Even if there is a storm in the future, I know that I will be much better prepared for it.

I vow to give You all of the praise and all of the glory. In Jesus’ name I pray.

Amen.